Andreas Charalambous and Omiros Pissarides*

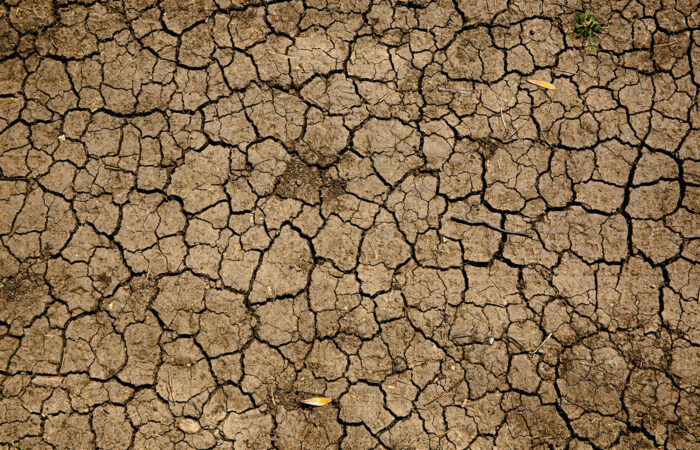

The Kingdom of Saudi Arabia (SA) is an example of a state, whose economic and foreign policies have traditionally centered around its natural wealth. Any analysis of SA cannot, therefore, ignore the importance of oil. The country is covered by vast areas of desert, does not have a single river within its borders, and is characterized by an administrative/governmental structure that is completely dependent on the power of the Saud family and the Islamist ideology. Despite its inherent weaknesses, SA has based its economic growth in recent decades on fossil fuels, particularly oil, and has amassed enormous wealth. With a GDP that exceeded $800 billion in 2021, it is among the 20 largest economies on the planet, while its geopolitical importance has fostered the creation of close relations with the world’s superpowers, especially with the USA.

Conditions, however, are changing. In recent years, the expanding environmental challenges, and the consequent decline in the importance of oil, underpin the need to modernize the SA economy. The current, de facto, leader of the country, Mohammed bin Salman (MBS), is just 37 years old and seems to understand the new realities. Although several events have angered political analysts and human rights organizations (as was the case of the peculiar resignation announcement of the Lebanese Prime Minister in 2017 during a visit to the capital of SA, Riyadh, and the 2018 killing of the dissident journalist Khashoggi at the SA Consulate in Istanbul), MBS is generally considered a reformer. The following may be identified as the key modernization actions he has undertaken and the related challenges he is facing.

Firstly, MBS recognizes both the importance of renewable energy and the need to invest in innovative sectors that will reduce his country’s dependency on oil. In this regard, he has announced “Vision 2030”, a strategic framework that foresees the diversification of the economy through the development of various service sectors, such as health, education, infrastructure, recreation and tourism. This grand vision includes the creation of “Neom”, an entirely new city on the Red Sea, which will rely solely on renewable energy sources and modern technology (such as autonomous vehicles and robots for mundane tasks).

During the period 2014-2020, the price of oil fell by 50%, the country’s foreign exchange reserves declined from $740 billion to $475 billion, and the progress of the $500 billion “Neom” project has been delayed. At the same time, the vision for tourism appears, for now at least, to be impacted by the lack of the necessary infrastructure and the inability of establishing Saudi Arabia as an attractive and quality tourist destination, while, admittedly, the pandemic did not contribute positively.

Secondly, MBS understands the challenges of the extreme Islamist ideology, which restricts women’s rights. Having already extended the, self-evident, right to women to drive, not only increases disposable income, which for many years was spent on driver wages, but also contributes to the swifter and easier integration of 50% of the population into the workforce.

Thirdly, recognizing the primary importance of cultural development and its catalytic effect on matters of economic progress, in line with modern economic thinking, MBS focuses on the problems of the perennial culture of privilege and subsidy that has become entrenched in SA. The wealth of the country is closely controlled by around 2,000 members of the royal family, it is not channeled proportionally to the rest of the population of the Kingdom, while it also leads to phenomena of corruption. To satisfy the population, maintain a climate of social peace within the different classes and religious groups that exist in the country, and also to attract foreign workers, the government has created one of the most generous welfare states globally. For example, petrol, electricity and water are offered at extremely low prices, creating undesirable side effects. More specifically, the country is the sixth largest oil consumer worldwide with air conditioning systems accounting for 70% of local consumption. At the same time, SA operates the world’s largest desalination plant but supplies the water at low prices to sustain the local crop export industry. Changes are much needed and the government has taken a series of unprecedented decisions:

(a) A plan to “saudize” the workforce has been announced. With foreign workers amounting to about 12 million, out of a total population of 34 million, the stakes are high. Women’s integration constitutes a move in the right direction, but it is considered difficult for young unemployed Saudis to accept the type and conditions of work of foreign workers, even though the under-24 unemployment rate is over 25%.

(b) MBS does not hesitate to cooperate with traditionally less friendly countries, when circumstances require it. Economic relations with China are being strengthened, while the UAE’s, relatively recent and historic, agreements with Israel were concluded with the agreement of the SA government.

(c) The government is taking steps to limit the cultivation of species that require intensive irrigation (for example wheat), is moving crop production abroad by purchasing land in other countries, through its sovereign wealth fund, and, at the same time, promotes the use of solar energy production technologies.

(d) Recognizing the cost of the above, the government seems willing to contribute through its most important asset, Saudi Aramco. The world’s largest oil company raised about $29 billion in the world’s largest initial public offering in late 2019 while, in a key decision, in February 2022, a 4% stake in Saudi Aramco was transferred to the country’s sovereign wealth fund.

Recent geopolitical developments and Russia’s invasion of Ukraine have contributed to the increase in oil prices. While this development will, temporarily, boost SA finances, the challenges of transforming the Kingdom into a modern economy shall remain and the world will be watching the country’s progress with interest.

*Andreas Charalambous is an economist and a former director in the Ministry of Finance. Omiros Pissarides is the managing director of PricewaterhouseCoopers Investment Services. This article is a revised and extended version of a previous article, published in Kathimerini on September 4, 2022 and in Cyprus Mail on September 11, 2022.