Charles Ellinas*

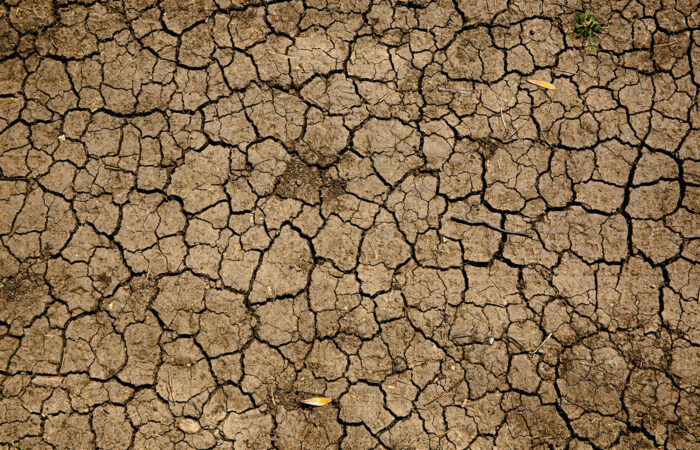

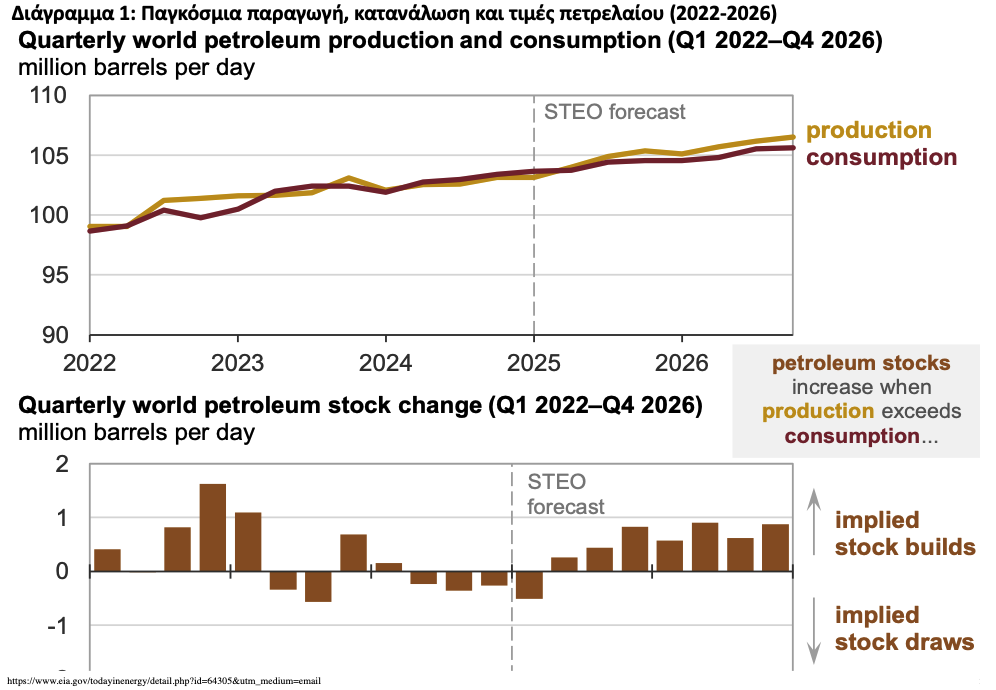

The US Energy Information Administration has just published new forecasts for oil production, consumption and prices to the end of 2026 as shown in Figures 1 and 2 below.

Figure 1: World petroleum production, consumption and prices (2022-2026)

https://www.eia.gov/todayinenergy/detail.php?id=64305&utm_medium=email

Clearly, despite the push for renewables, oil demand remains high and continues to grow without any signs of reaching a peak this decade, as the International Energy Agency (IEA) predicts. Oil and gas continue to dominate the global energy mix.

As the ‘Oil Price’ points out, “the fact that the world relies on petroleum to function was made clear quite recently when oil prices jumped on the news that the outgoing Biden administration had announced one parting round of sanctions against Russia’s energy industry, focusing specifically oil and gas exports. Had oil demand been really weakening under the weight of all those electric vehicles, the effect of the sanctions on oil prices would have been negligible. But it wasn’t.” The world still very much runs on oil.

In the past, the EIA demonstrated close agreement between its forecasts of oil production and actual outcome in the period 2022 to 2024. This gives credibility to its forecasts of oil production, consumption and prices this year and next.

Figure 2: Monthly Brent crude oil price (2022-2026)

https://www.eia.gov/todayinenergy/detail.php?id=64305&utm_medium=email

The EIA forecasts that global demand for oil will continue to grow, by 1.8 million barrels/day (mb/d) in 2025 and 1.5 mb/d in 2026.

More importantly, it also shows Brent crude prices falling, from an average of $81/b in 2024 to $74/b in 2025 and $66/b in 2026. It attributes this to strong global growth in oil production and slower demand growth that together put downward pressure on prices. As a result, the EIA expects OPEC+ members to continue to restrain production in 2025 and 2026 to prevent prices from falling further.

Goldman Sachs forecasts $70-$85/b in 2025, warning of volatility from sanctions and tariffs.

Uncertainties

The EIA forecast was produced before the latest US sanctions on Russia in December and before Donald Trump became the new US President. Both have the potential to impact global markets, introducing price uncertainty and volatility in 2025.

Such uncertainties may increase because of President Trump’s “difficult to predict” new energy policies, especially after his declaration of energy emergency that would unlock additional powers to unleash domestic energy production. He lost no time and at his inauguration he repeated the rallying cry of “drill baby, drill” from his successful election campaign. If that works, prices may come down further over the next two years.

The same will happen if OPEC+ fails to continue restraining oil production. But OPEC+ ‘forward guidance’ on production indicates that, for now, for 2025 and 2026, it plans to continue its current ‘production management’ mode.

The Chinese factor may also send prices up, if the new fiscal policies succeed in stimulating economic growth, or down, if the market penetration of electric vehicles accelerates faster.

In addition to these factors, geopolitical tensions in the Middle East and harsher sanctions on Iran, could also play a significant role in influencing oil prices. Any escalation in conflicts or instability in key oil-producing regions could lead to supply disruptions, causing prices to spike. Conversely, diplomatic resolutions and peace agreements could stabilize the market, potentially leading to lower prices.

The readiness of countries to buy more American oil and gas to appease Trump will also be a factor. “Expect the unexpected” may become the new norm in 2025.

*Charles Ellinas is Senior Fellow at the Global Energy Centre of the Atlantic Council.