Maria Demertzis*

The global fight against climate change suffers from a problem that holds back international action in many areas: countries make promises and set goals, but then fail to stump up sufficient financing to make them happen.

That is why a new initiative, known as the Bridgetown Initiative (BI), put forward by the government of Barbados, and best explained here, should not be ignored. It is an attempt to differentiate between different climate objectives and to then suggest how the work towards these different objectives can be financed. The motivation behind this initiative is that climate finance is both scarce and expensive, particularly for very poor countries.

The BI’s first suggestion, which was indeed adopted by the 2022 United Nations climate summit, was for a loss-and-damage fund to help the most climate-vulnerable countries and to deal with climate justice. The initiative encourages the inclusion of a natural disaster clause which would stipulate a temporary suspension of interest rate payments on debt owned by the country hit by climate disaster. This would provide liquidity to the nation hit by the disaster.

Additionally, the money that a nation would need for rebuilding should not be given in the form of loans but rather in the form of grants. The BI argues that when faced with such natural disasters, debt finance is inappropriate as it would add to the piles of debt in what are typically already very highly indebted countries. The BI even suggests adding a clause to the loss and damage fund whereby a grant is given automatically if the climate event is responsible for the destruction equivalent to 5% or more of GDP, as assessed by an external agency. The BI also recommends that the funds are collected through a levy on fossil fuel companies linked to their carbon content. It estimates that, based on pre-COVID-19 oil and gas prices, such a levy could lead to $200 billion being collected annually.

The BI also recommends an increased role for multilateral development banks (MDBs) in helping fund climate adaptation. The BI argues that events that are linked to climate adaptation are quite difficult to fund privately and that necessarily leaves an increased role for governments. But with debt levels already high in the wake of the pandemic, many poor countries have no fiscal space and face very high borrowing rates on the markets. By expanding the role and funding base of MDBs, countries can borrow at rates below the market price.

But perhaps the most interesting BI proposal is that a fund should be created to deal with the economic opportunities that climate mitigation presents. The BI recommends the creation of a $500 billion Global Climate Mitigation Trust to fund climate projects.

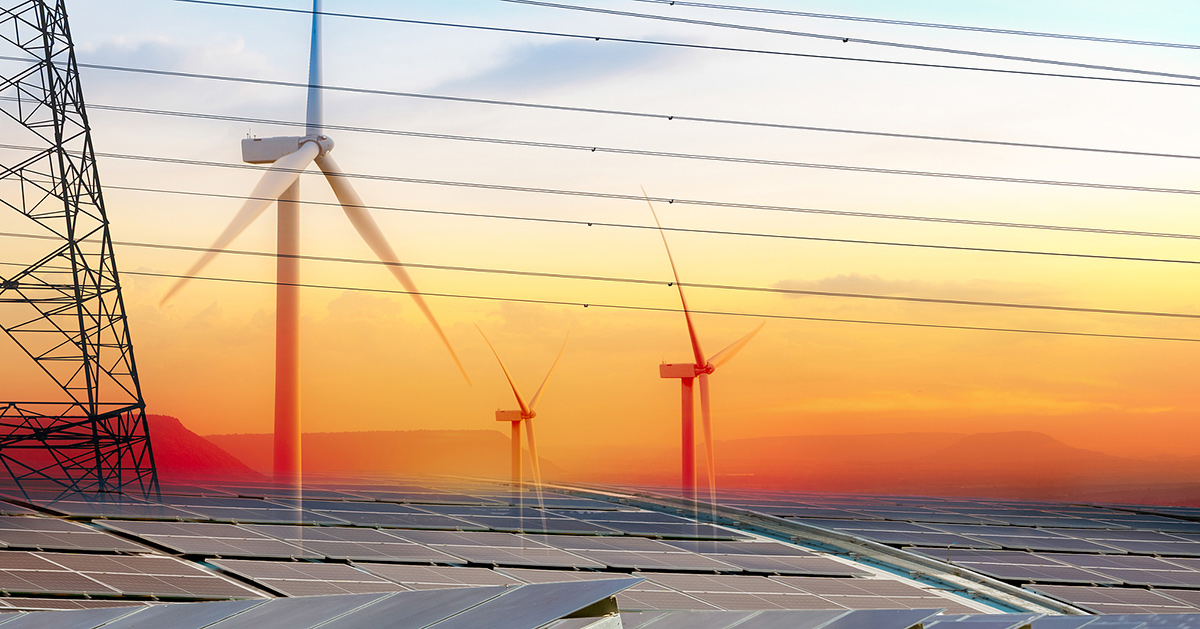

Mitigating the effects of climate change

Two aspects of this suggestion are novel and interesting. First, the BI recommends funding the Global Climate Mitigation Trust through unused Special Drawing Rights (SDRs) issued by the IMF. SDRs are international reserve assets allocated to IMF members that allow for each member to borrow from one other’s central bank reserves in case of distress. Importantly, borrowing costs are kept well below market value, currently at 2.4%. As SDRs are allocated according to size of country, it is predominantly the big, wealthy countries that do not actually need them that own the bulk of them. The BI encourages countries to commit part of their unused SDRs to this fund, which can then be used to leverage private funding via cheap loans earmarked for climate-related projects.

The second interesting characteristic of interest is that these loans would be the fund’s assets, but would not be any country’s liability, and would therefore not add to any country’s debt. The loans will be the funded projects’ liability and will therefore constitute a type of ‘third debt’. In this respect, it is not dissimilar to the NextGenerationEU fund that the European Union put together during the pandemic, which, at least for its grant component, is funded by EU debt but does not count as part of any EU country’s debt. Funding projects without having to issue new debt is an attractive proposition for countries that are heavily indebted. But making sure that such a financial instrument is operable requires both carefully selected projects and sufficient provisions of collateral to cover the underlying risks.

Climate finance remains the number one problem to solve. Initiatives that think outside of the box could help tackle the perennial problem of over-promising and under-delivering.

*Maria Demertzis is a Senior fellow at Bruegel and part-time Professor of Economic Policy at the School of Transnational Governance at the European University Institute in Florence. The article is published by Bruegel and is also posted on the blog of the Cyprus Economic Society.