Nektarios Michail*

The recent geopolitical tensions that keep erupting around the world have underlined the fact that Europe and the US may likely be unprepared, and are definitely underperforming, in terms of weapons production. In a recent speech, NATO secretary Mark Rutte noted that “in terms of ammunition, Russia produces in three months what NATO produces in a whole year.”

While many countries have, by now, increased demand for various types of ammunitions, Europe lacks both the factories as well as the raw materials that are required to produce them. In a clear example of this situation, factories that produce basic chemical explosives are now scarce in Europe, with most having shut down by the end of the 20th century, and the remaining ones now having backlogs for a few years.

Even if factories in Europe are rebuilt or expanded, the raw materials that are required still need to be imported. For example, nitrocellulose, a widely used chemical compound in ammunition, is obtained from cellulose, a plant matter usually derived from cotton linter or wood pulp. In addition to factory deficiency, Europe produces only around 4% of the world’s total cotton production, and imported more than €2.8 billion worth of cotton in 2024. While the value of cotton imports is not large in monetary terms, its absence suggests that it is even harder for the EU to ensure autarky in the production of ammunition, even if the number of available factories increases.

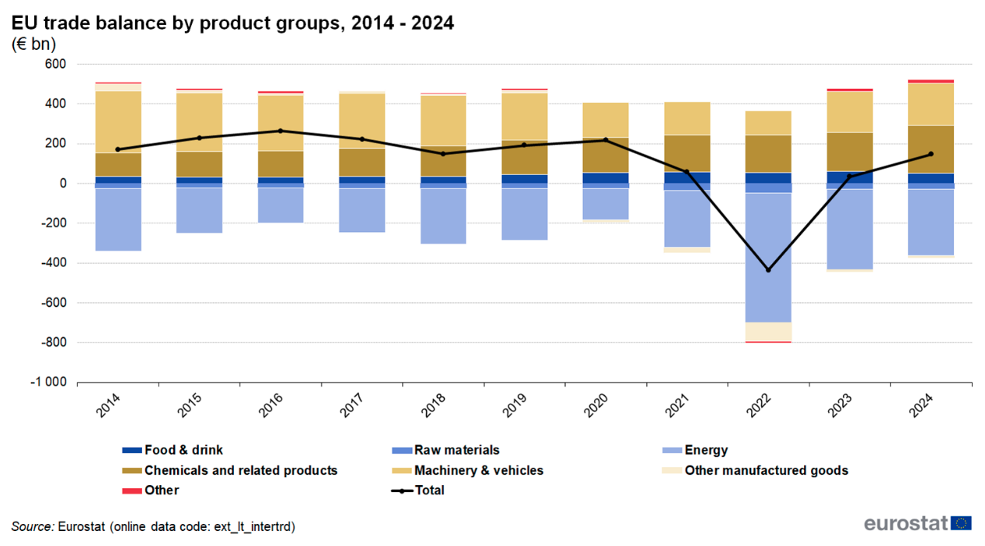

The same holds true for other key materials in weapons’ production. For example, European iron production had declined to approximately 3% of global mining output by 2018, from more than 40% a century ago, with its import dependency standing at around 50% in 2024. More so, the continent relied on net imports for 94.8% of its energy availability in 2023, with both petroleum and LNG imports (in volume) standing at or above their 2021 levels, with the closing down of nuclear power plants further exacerbating energy needs. Concerning rare earth elements (magnesium, gallium, ferro-niobium, etc.), which are critical for AI and other defence applications, EU imports were 2.5 times higher exports in 2024, with 95% of them coming from China, Malaysia, and Russia.

The above is usually not accounted for when it comes to measuring the extent to which European defence is dependent on other countries. However, approximately 50% of total imports are made by industrial firms, despite them being only about 14% of all firms. As a result of the European dependence on raw materials and energy imports (see chart below) and the secular decline in military spending prior to 2024, around 80% of European weapons procurement happened outside the EU (mainly from the US).

Given the above, it can only be expected that military spending in the EU will not have a strong effect on the economy. While Germany announced additional spending of approximately 1% of GDP each year, the end effect is unlikely to be large. The German economy relies 40% on capital and has a labour share of 60%, suggesting that an upper limit of around 60% can be placed on the pass-through of military expenditure, given the need to import raw materials. Naturally, this average masks the fact that manufacturing usually has a lower labour content. Furthermore, since approximately half of household consumption in the country is also imported, a 1% increase in spending is not likely to impact growth by more than 0.2%-0.3%, given the small contribution from the capital side due to the high import content; the impact on inflation can be expected to be much lower. While these back-of-the-envelope calculations are crude, and depend on a variety of factors, other estimates suggest that the short-term effect is likely to be even smaller, with a recent study noting that if spending is financed via tax increases instead of borrowing the short-term effect may turn out to be negative.

Another potential for boosting growth appears to exist with regards to the (potential) productivity spillovers. Yet, as per the Draghi report, only 4.5% of EU military spending is aimed at R&D, in contrast with approximately 16% for the US. Even in the case of an interplay between private and public capital, the potential outcome remains murky. In an example of how the two are related, while the most important breakthroughs in the semiconductor industry during the cold war era were due to private R&D investments, these were made with a view on military procurement contracts. Basically, the idea was that any new developments in semiconductors would be welcomed by the military and new contracts would be awarded, hence companies had incentives to employ more of their private capital in R&D. However, there is no guarantee that this is politically (or bureaucratically) feasible in the EU, and firms may choose to promote their innovations in the US or the UK, where military contracts may be more easily granted.

Thus, any positive productivity spillovers from military spending may not be the case in the EU, at least to the extent they are in the US. As most studies employ US data, useful conclusions are harder to derive; while some productivity gains may occur, these are unlikely to be meaningful, unless a relevant civilian application also emerges.

What do all the above mean? While much brainpower has focused on the effect that military spending can have on the economy and inflation, it would be best if we focused on what could happen if no additional spending is made. Defence weapons and munitions are more like an insurance policy, acting as a deterrent and supporting the survivability of a nation. One of the consequences of the post-cold war “peace dividend” appears to have been the belief that the possibility of conflict was near zero, and a certainty that the future will remain bright under whichever circumstances, a narrative that no longer holds.

While estimates of the impact that military spending can have on the economy suggest that it likely to be small in the short-run, emphasis should not be placed on the direct economic effects but on the “peace of mind” impact: more military spending improves the probability that the EU will be able to deter any potential threats and to remain one of the key blocks of the world. Si vis pacem, para bellum, as the Romans said. Since Germany (unlike France and Italy) has the fiscal space to promote higher defence spending, this should be done without concentrating on any potential short-term effects, which are likely to be on the lower end.

Instead, focus should be placed on a long-term view of boosting economic stability via having enough firepower to act as a deterrent. This would ensure the survival of the EU and eventually promote economic growth via geopolitical stability. Naturally, the core of a rearmament strategy lie raw materials: Europe needs to revisit both its energy strategy and the key raw materials it needs, with an aim to ensure a higher level of autarky, something that would boost not only its war capabilities but would also have broader beneficial social effects.

*Nektarios Michail is Economics Research Manager at Bank of Cyprus. Views expressed are personal.